In a post-Operation Sindoor world, where regional tensions have escalated, India’s latest defence splash might look like the start of a costly arms race. On December 29, 2025, the Defence Acquisition Council (DAC), chaired by Defence Minister Rajnath Singh, cleared procurement proposals worth nearly ₹79,000 crore—one of the largest single-sitting approvals in recent history. This includes high-tech drones, precision missiles, advanced radars, and naval surveillance systems, all under the “Acceptance of Necessity (AoN)” stage, paving the way for contracts and production.

At first glance, for a developing nation still battling infrastructure gaps, healthcare shortages, and education challenges, spending roughly $8.8 billion in one go feels like a luxury we can ill afford. But dig deeper, and this deal reveals itself as a masterstroke: it bolsters national security while supercharging economic growth through indigenous manufacturing. It’s a classic case of killing two birds with one stone—achieving strategic autonomy while fueling industrial and job creation under the Atmanirbhar Bharat banner.

)

Defence Minister Rajnath Singh during recent high-level meetings related to defence procurements.

The Context: Post-Sindoor Modernisation Drive

The timing isn’t coincidental. Recent border frictions and evolving threats in the subcontinent have accelerated India’s military modernisation. The armed forces need cutting-edge capabilities: beyond-visual-range missiles for air dominance, loiter munitions for precision strikes, multi-launch rocket systems for artillery superiority, and drone detection systems to counter unmanned threats.

This ₹79,000 crore package addresses these gaps head-on. But unlike past deals dominated by imports, this one prioritises “Make in India.”

The Atmanirbharta Edge: Over 90% Indigenous

The cornerstone of this approval is self-reliance. More than 90% of the contracts are reserved for Indian companies—both public sector undertakings (PSUs) and private sector innovators. Taxpayer money stays in India, building domestic capabilities rather than enriching foreign vendors.

Key indigenous beneficiaries include:

- Bharat Electronics Limited (BEL): Leading production of advanced radars and Software Defined Radios (SDRs) for seamless communication.

- Bharat Dynamics Limited (BDL): Manufacturing the lethal Astra Mk-II Beyond Visual Range Air-to-Air Missile, enhancing IAF’s combat edge.

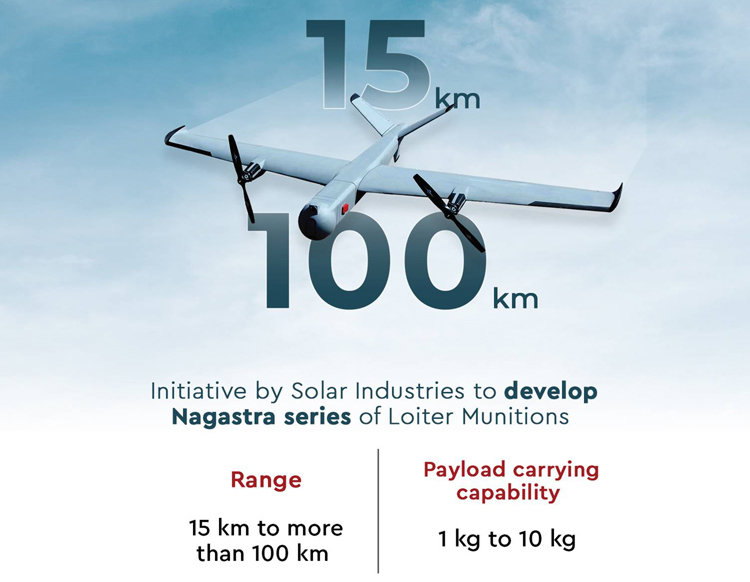

- Solar Industries / Economic Explosives Ltd: Pioneering loiter munitions (often called “suicide drones”) and advanced Pinaka ammunition. Indigenous loiter munitions like Nagastra—game-changers in precision warfare.

- Hindustan Aeronautics Limited (HAL): Developing Full Mission Simulators for the indigenous Tejas Light Combat Aircraft fleet.

- Zen Technologies: Delivering the Integrated Drone Detection and Interdiction System (IDD&IS) Mk-II.

- BEML: Producing heavy-duty launchers for the upgraded Pinaka Multiple Launch Rocket System (MLRS) with 120km range.

The only notable foreign elements are SPICE-1000 guidance kits from Israel and the leasing of High-Altitude Long-Endurance (HALE) RPAS like the MQ-9B drones from the USA. Everything else is built in Indian factories, from components to assembly.

The ₹1.5 Lakh Crore Multiplier Magic

Here’s where it gets exciting economically. Analysts estimate that this ₹79,000 crore domestic spending could add roughly ₹1.5 lakh crore to India’s GDP over the coming years, thanks to the “multiplier effect” of defence investments.

How does this work?

- Supply Chain Velocity: Each system involves thousands of sub-components—specialised steel, sensors, wiring, explosives, and electronics. These are sourced from over 16,000 MSMEs spread across tiers 1, 2, and 3 suppliers in states like Tamil Nadu, Karnataka, Uttar Pradesh, and Maharashtra.

- Massive Employment: Factories and R&D centres will employ lakhs of skilled workers—engineers, technicians, assembly line staff, and logistics personnel. Their salaries circulate back into the economy via consumption in housing, retail, education, and services.

- R&D Spin-offs: Technologies developed for missiles and drones (like advanced composites, AI-guided systems, and secure communications) create deep-tech talent pools. These skills often migrate to civilian sectors—telecom (5G/6G), aerospace (commercial aviation), automotive (EV batteries), and even healthcare (precision imaging).

- Export Potential: As production scales, India positions itself as a global defence exporter, earning valuable foreign exchange (e.g., BrahMos missiles already exported).

MSMEs powering India’s defence supply chain—thousands of small enterprises driving big growth.

From Liability to National Asset

In the past, heavy import dependence turned defence spending into a liability: depleting forex reserves, widening trade deficits, and boosting other nations’ GDPs. Today, with indigenisation at the core, this “arms race” becomes a stimulus package. It transforms the defence budget from a sunk cost into a strategic investment—building not just weapons, but a robust manufacturing ecosystem.

This approach aligns with global trends: countries like the US and China leverage defence spending for technological leadership and economic resilience.

Of course, challenges persist. Execution delays have plagued past projects, sustained R&D funding is crucial, and balancing defence with social welfare spending remains a tightrope. Over-reliance on a few PSUs could stifle innovation if private players aren’t equally empowered. Yet, the trajectory is clear: this deal marks a shift where security imperatives drive inclusive growth.

India isn’t just buying deterrence; it’s investing in a future as a self-reliant global powerhouse.

What do you think—is this the right way to blend security and economy, or should priorities shift elsewhere? Share your views in the comments!

Thank you for reading!!

Also read:

- India’s Defense Dilemma: The High Cost of Staying Behind in the Fifth-Generation Jet Race

- The Drone Race: A New Era of Innovation in India Amid Conflict

- Brain Drain, Imports, and 26 Lost Years: Why India Still Lags Behind F-35, Su-57 and J-20

- A Three-Day War That Shook the War Economy

- ASAT, ABM and the shifting Nuclear Paradigm

Leave a comment